In 1798, the Josiah Smith Tavern (above) was owned by Joel Smith, Josiah's son. The east two bays had not yet been added.

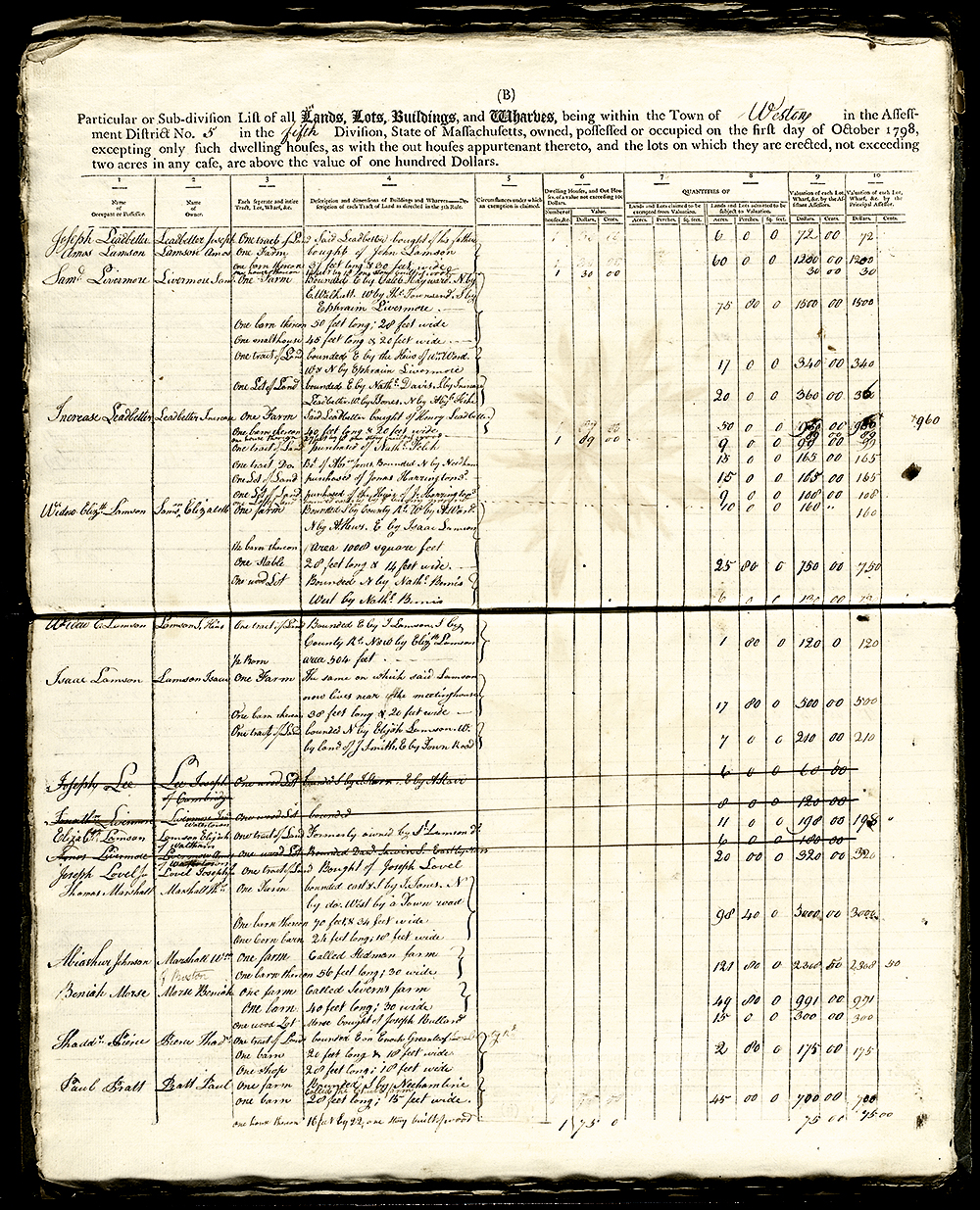

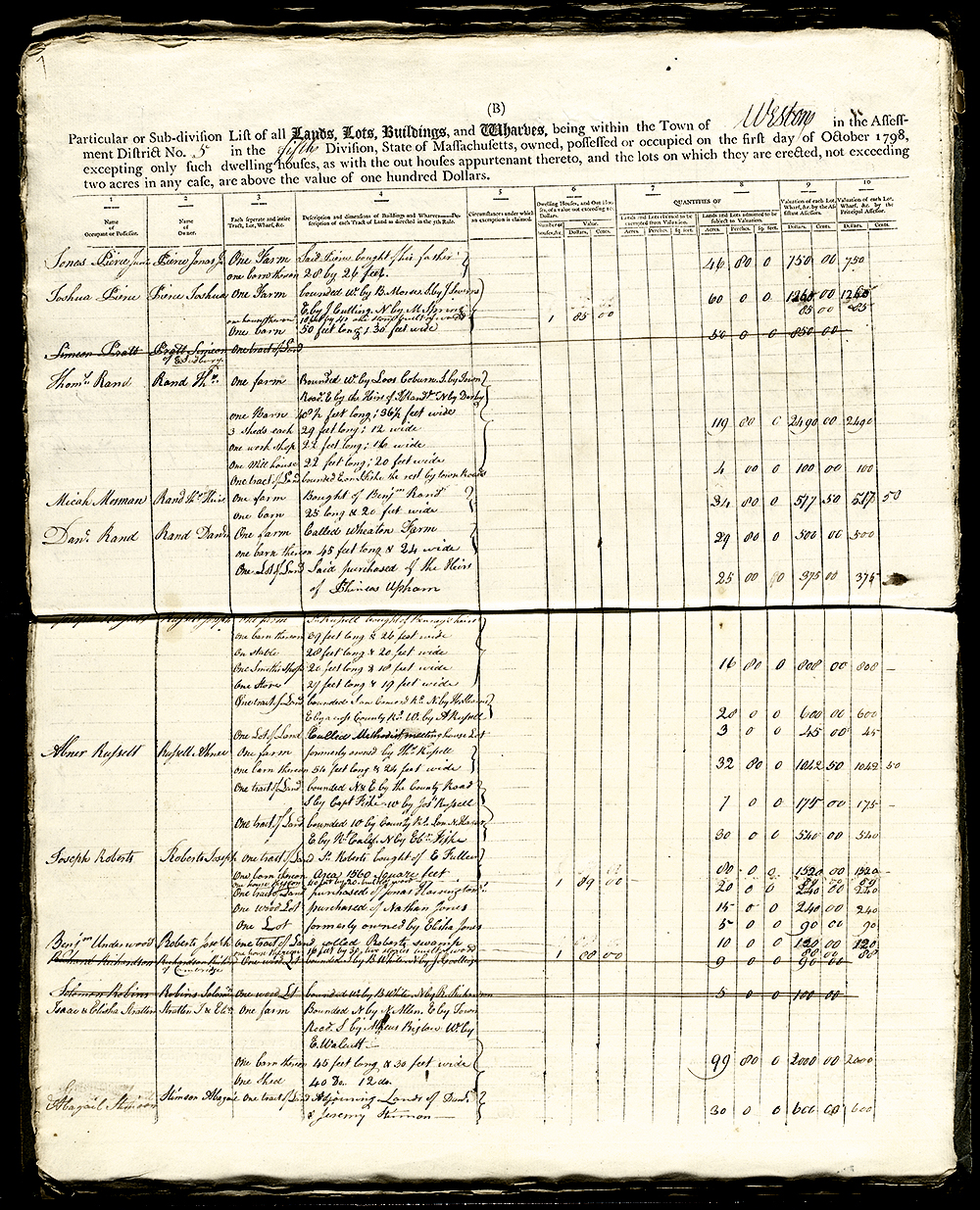

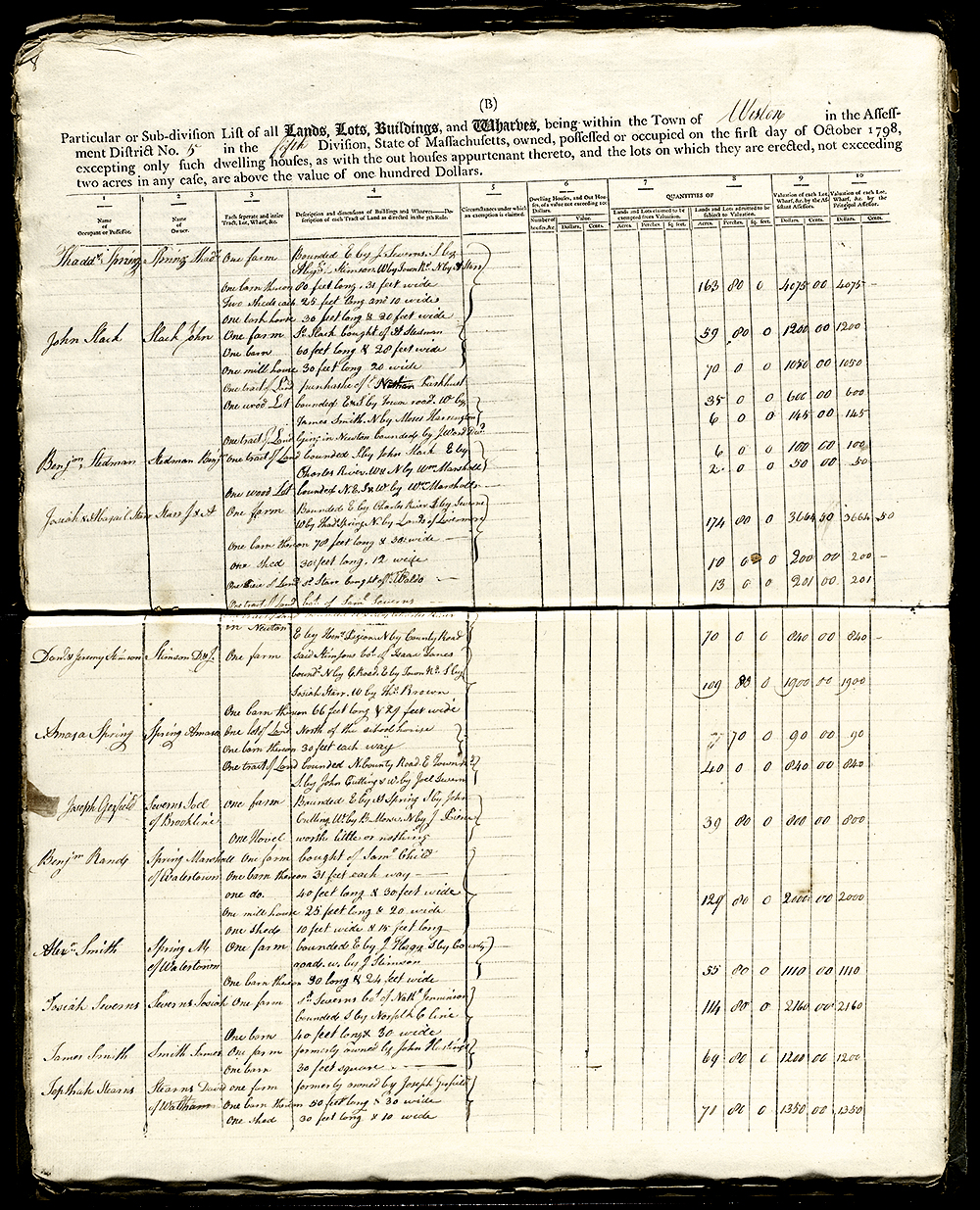

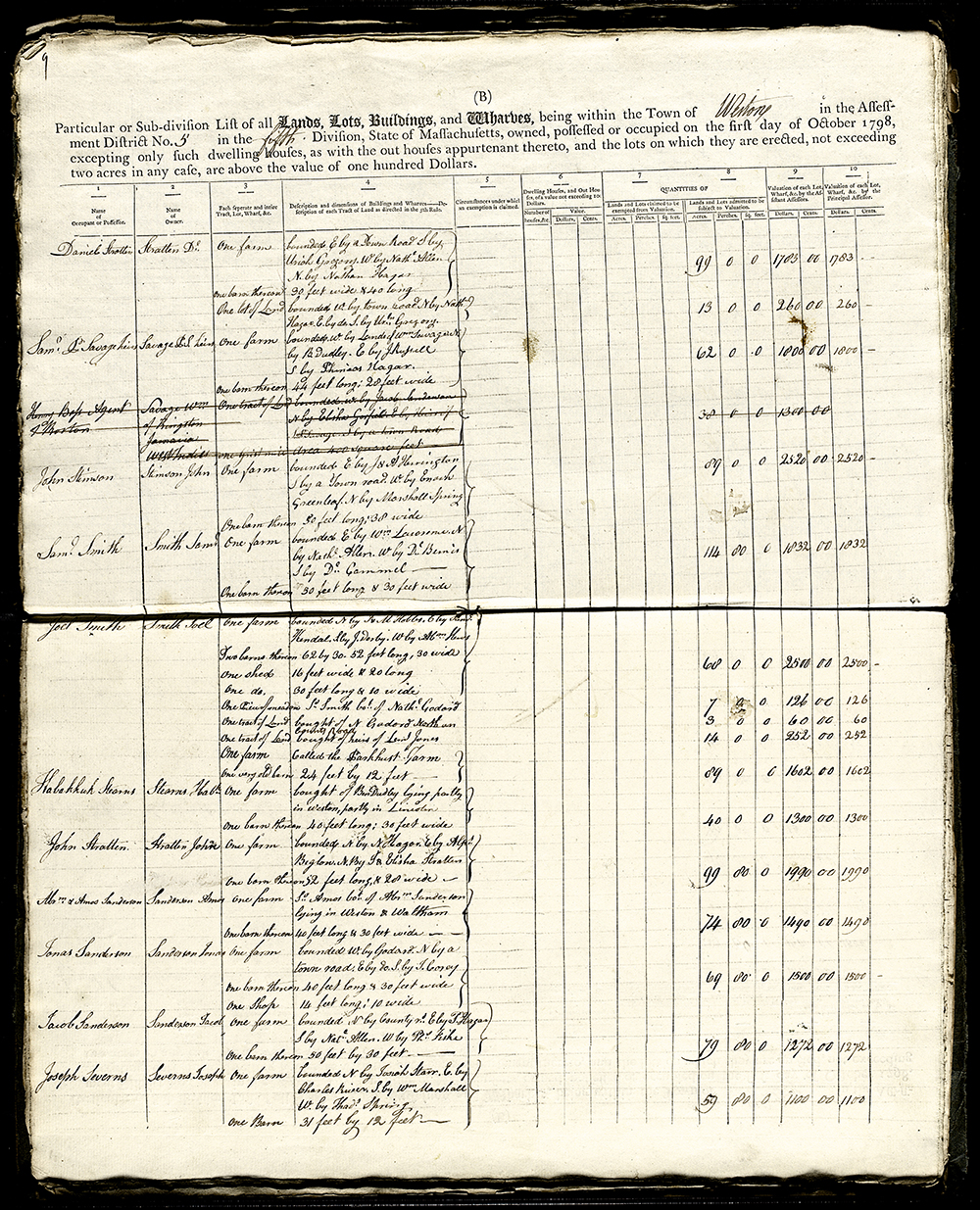

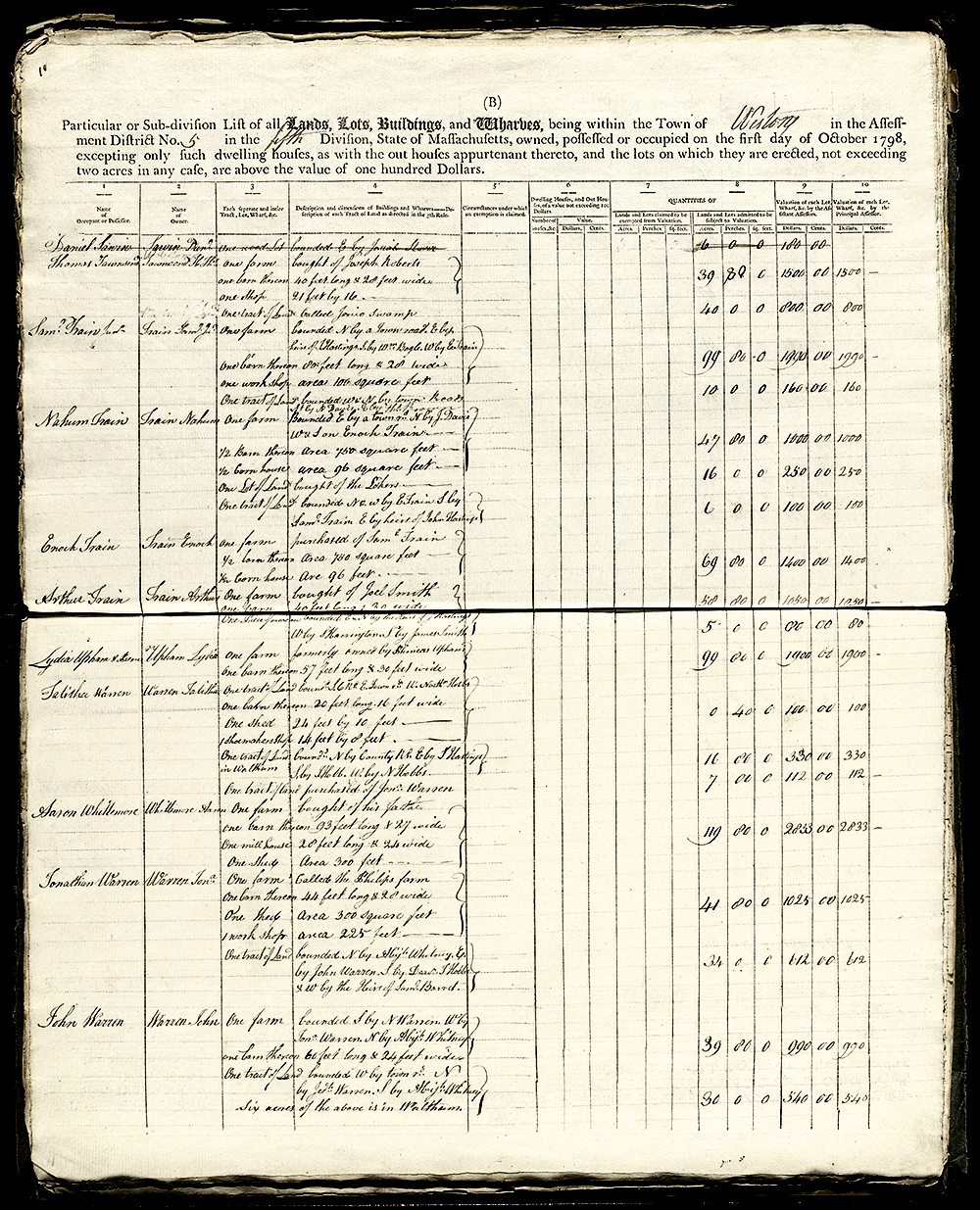

The Federal Direct Tax of 1798 (PDF), also known as the Window Pane Tax or Glass Tax, was levied by Congress in 1798 to raise money for a threatened conflict with France. The data gathered on dwelling houses and properties included details such as the number of windows and square footage of glass for each house valued over $100 as well as the dimensions of barns and outbuildings. More information can be found under "Topics: Federal Direct Tax of 1798" and on the internet.

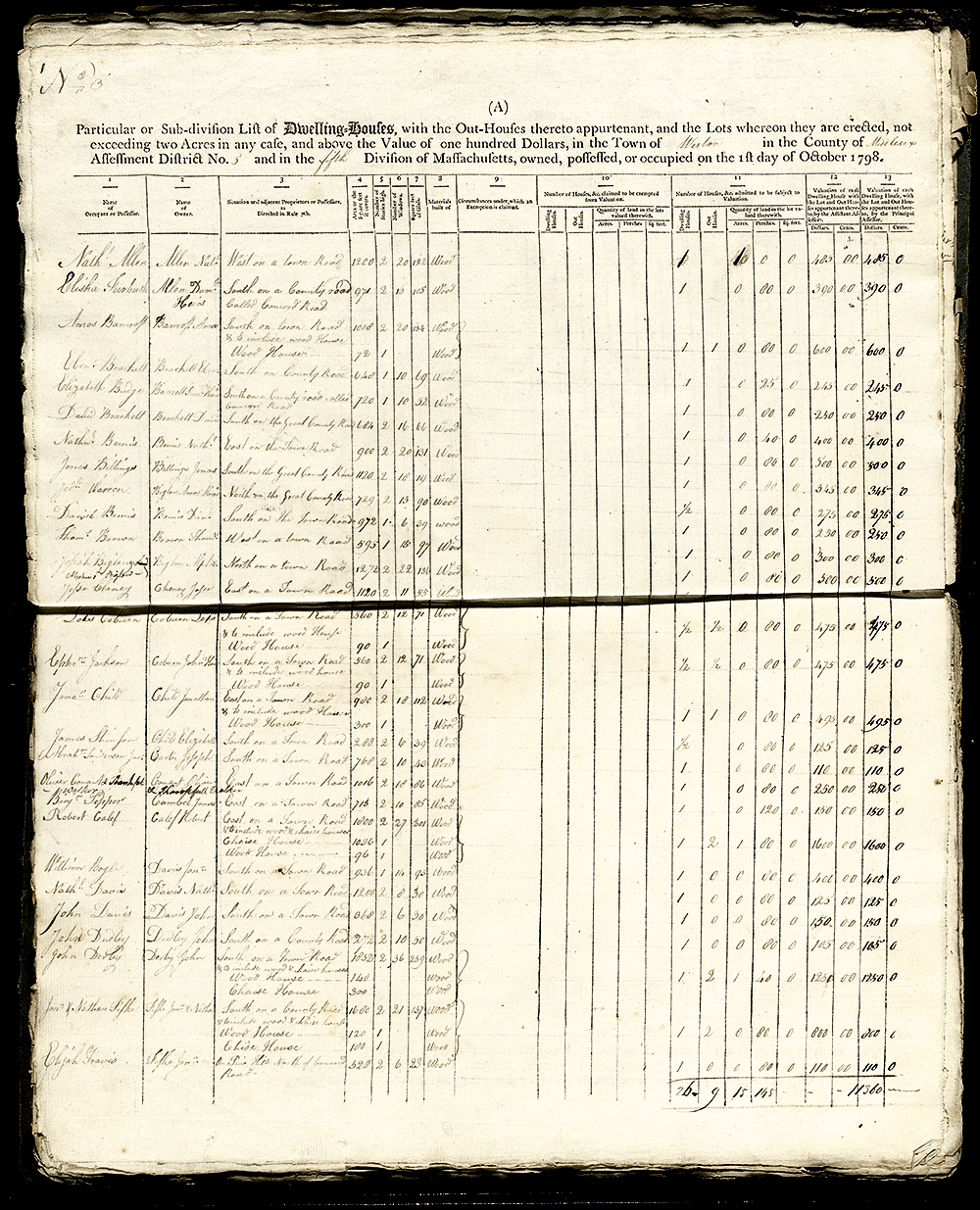

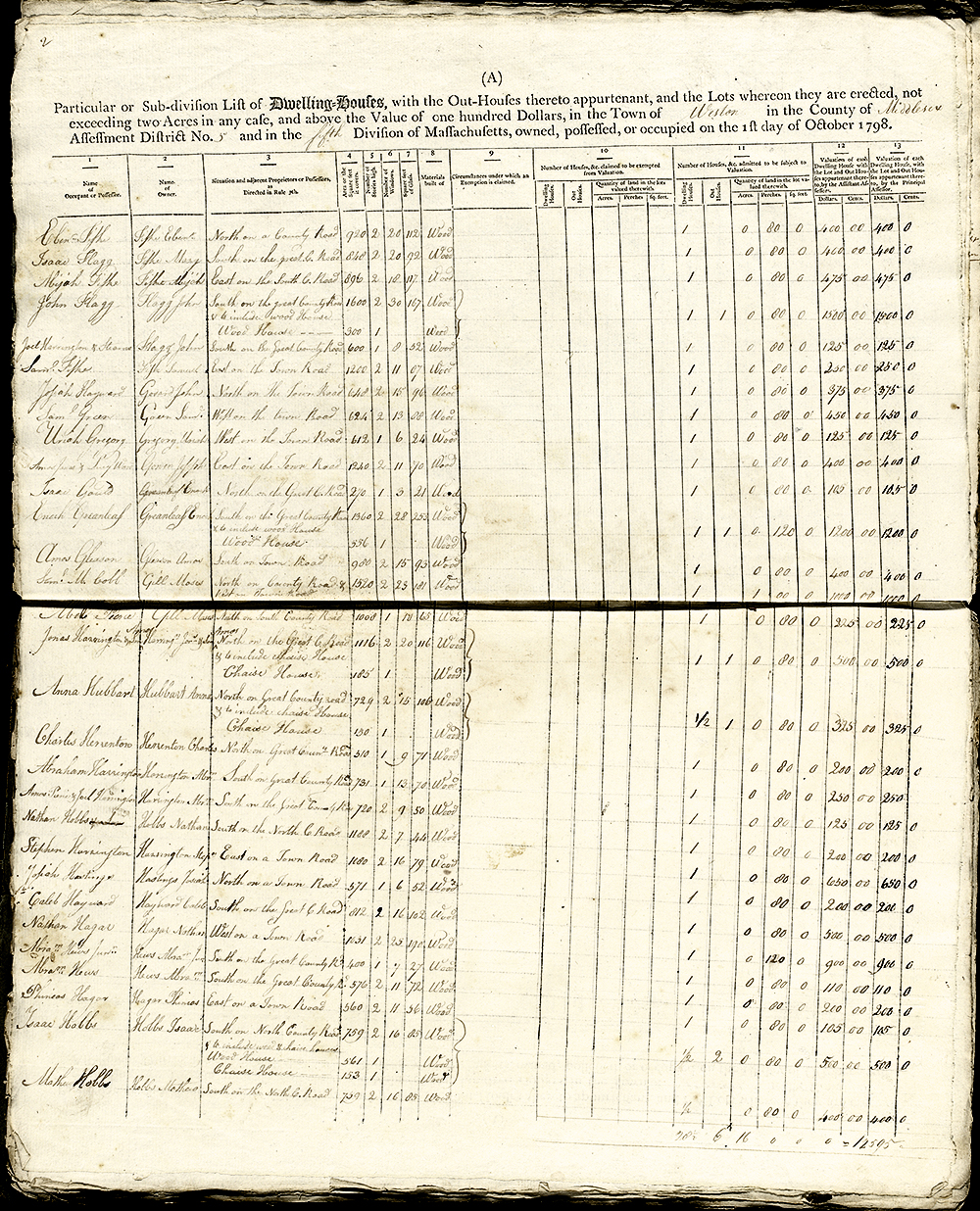

In the ledger, valuations were divided into two schedules, (A) and (B). The (A) list was for dwelling houses valued over 100 dollars.

If an A-list house was on a large property, the assessor considered only the two acres immediately around the house for Schedule (A) and included the rest of the property and outbuildings on Schedule (B) (see below).

Note that in Column 3, the descriptions often say something like “East on a Town Road.” This means that the property was bounded on the east by a town road, meaning that the house was on the west side of that road.

Schedule A: Dwelling Houses. Column 2 is alphabetical by owner: Nathaniel Allen to Jonathan Fiske

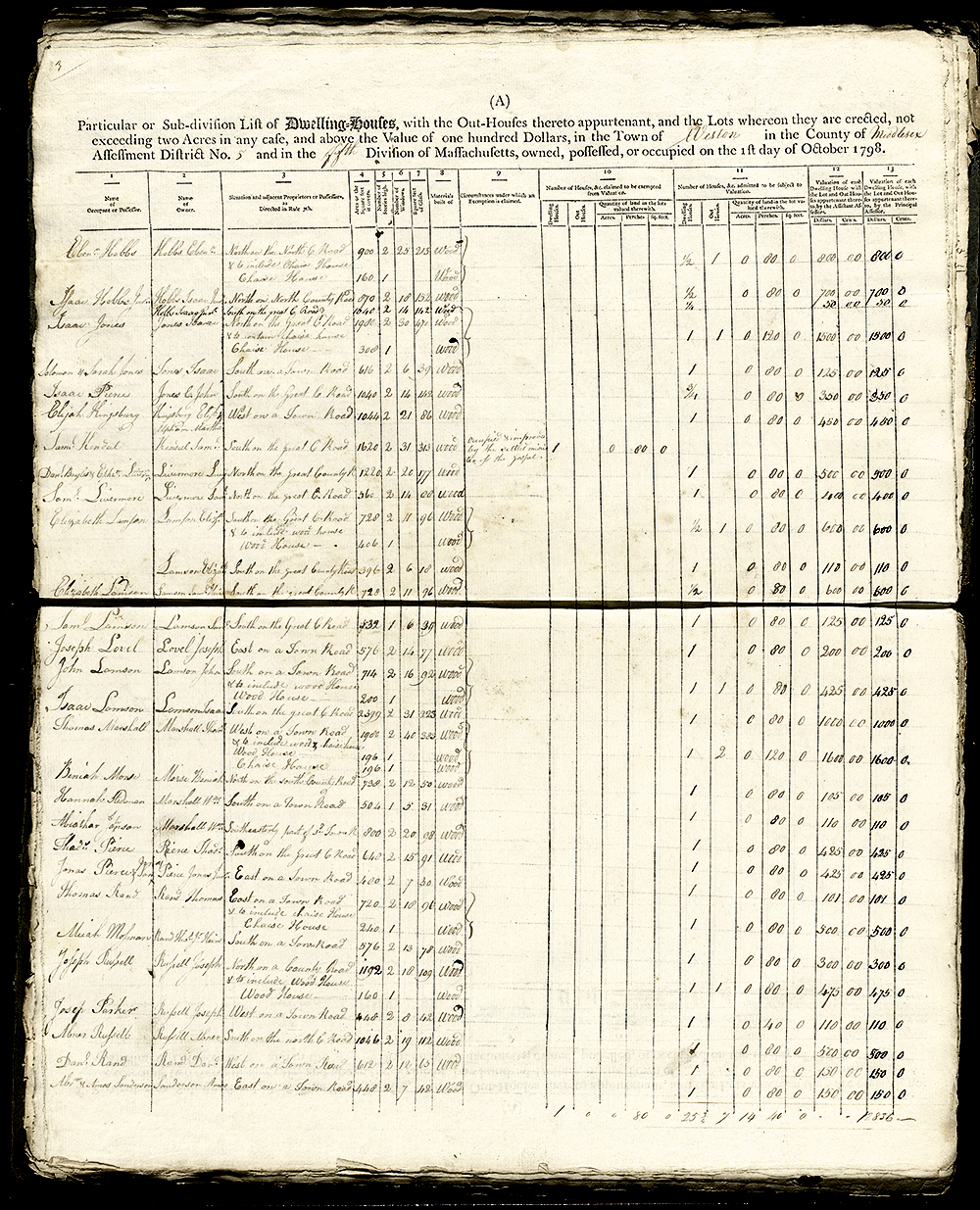

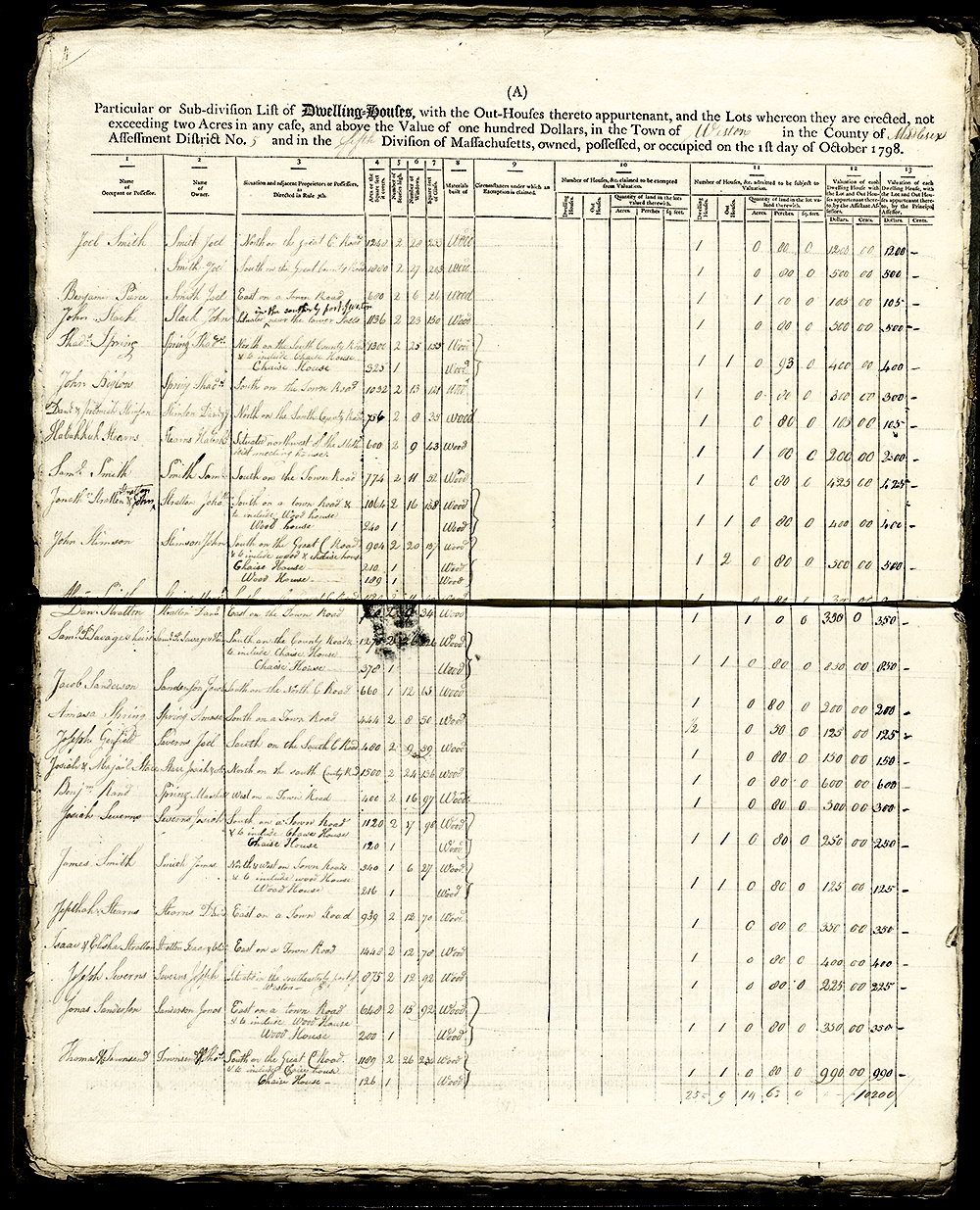

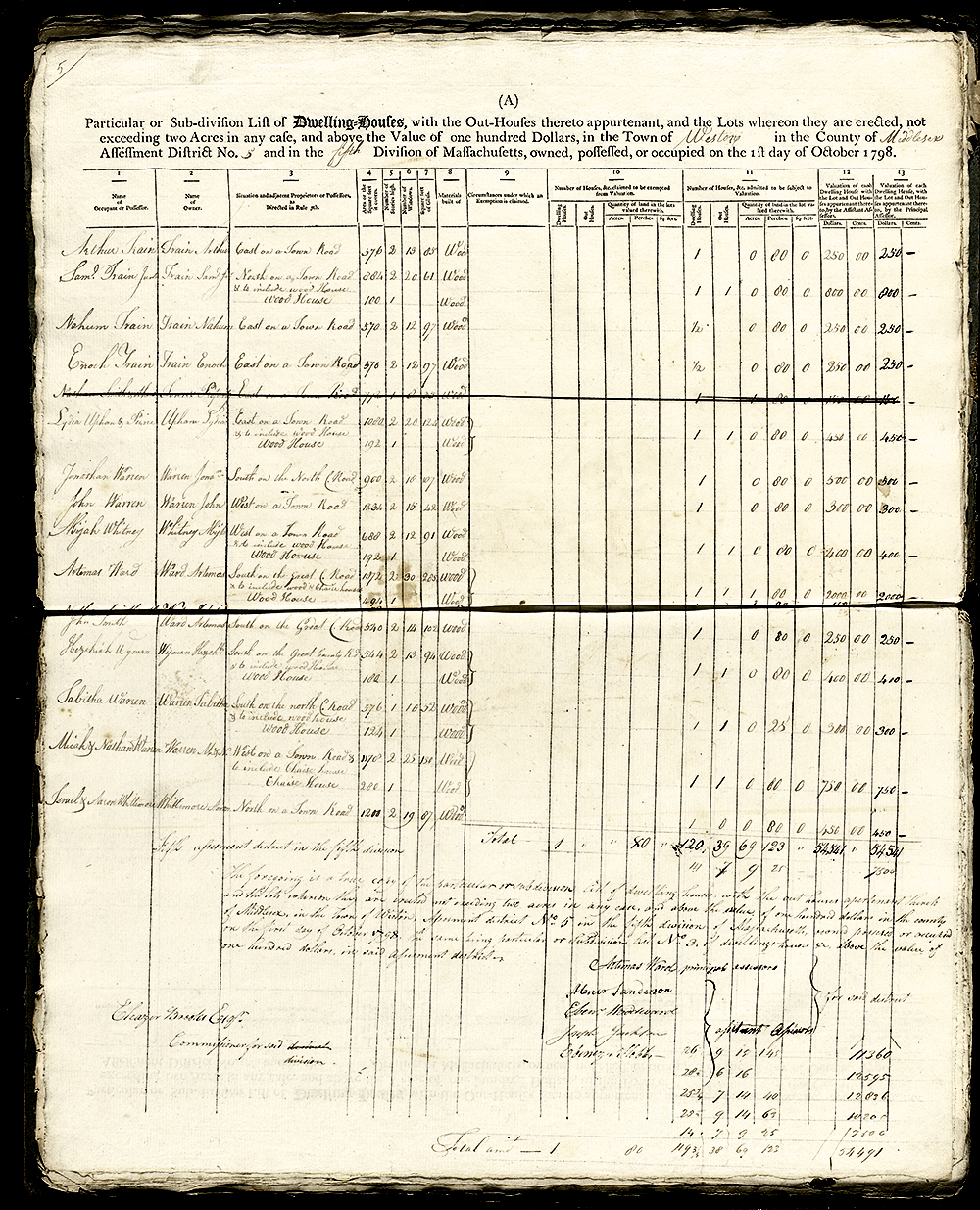

Schedule A: "Particular or Sub-division List of Dwelling-Houses, with the Out-Houses thereto appurtenant, and the Lots whereon they are erected, not exceeding two Acres in any case, and above the Value of one hundred Dollars, in the Town of Weston in the County of Middlesex Assessment District No. 5 in the Fifth Division of Massachusetts, owned, possessed, or occupied on the 1st day of October 1798"

Schedule A: Dwelling Houses. Column 2 is alphabetical by owner: Ebenezer Fiske to Matthew Hobbs

Schedule A: Dwelling Houses. Column 2 is alphabetical by owner: Ebenezer Hobbs to Amos Sanderson

Schedule A: Dwelling Houses. Column 2 is alphabetical by owner: Joel Smith to Thomas Townsend

Schedule A: Dwelling Houses. Column 2 is alphabetical by owner: Arthur Train to Aaron Whittemore

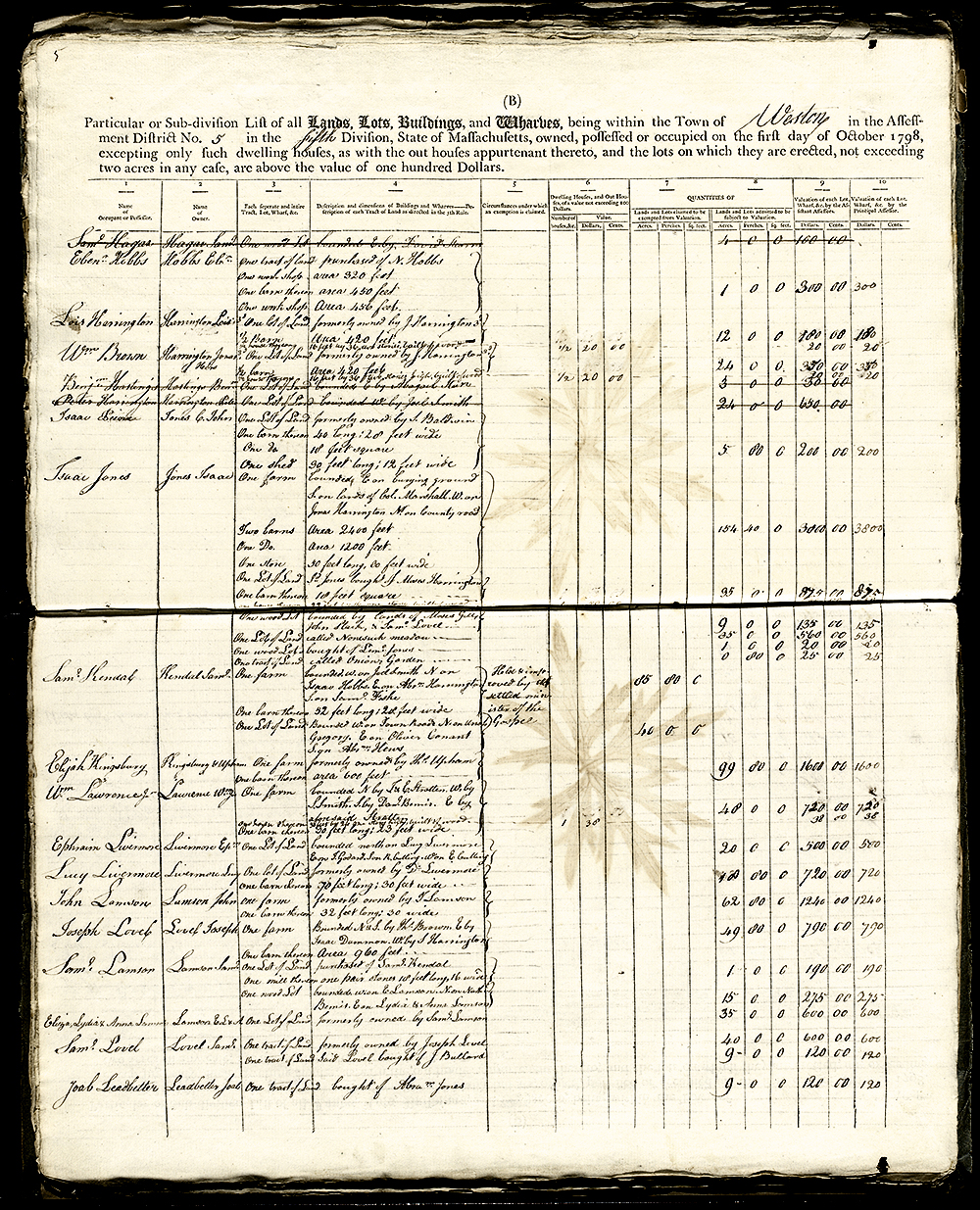

The Golden Ball Tavern (above) can be found on Schedules (A) and (B) under the name of owner Isaac Jones.

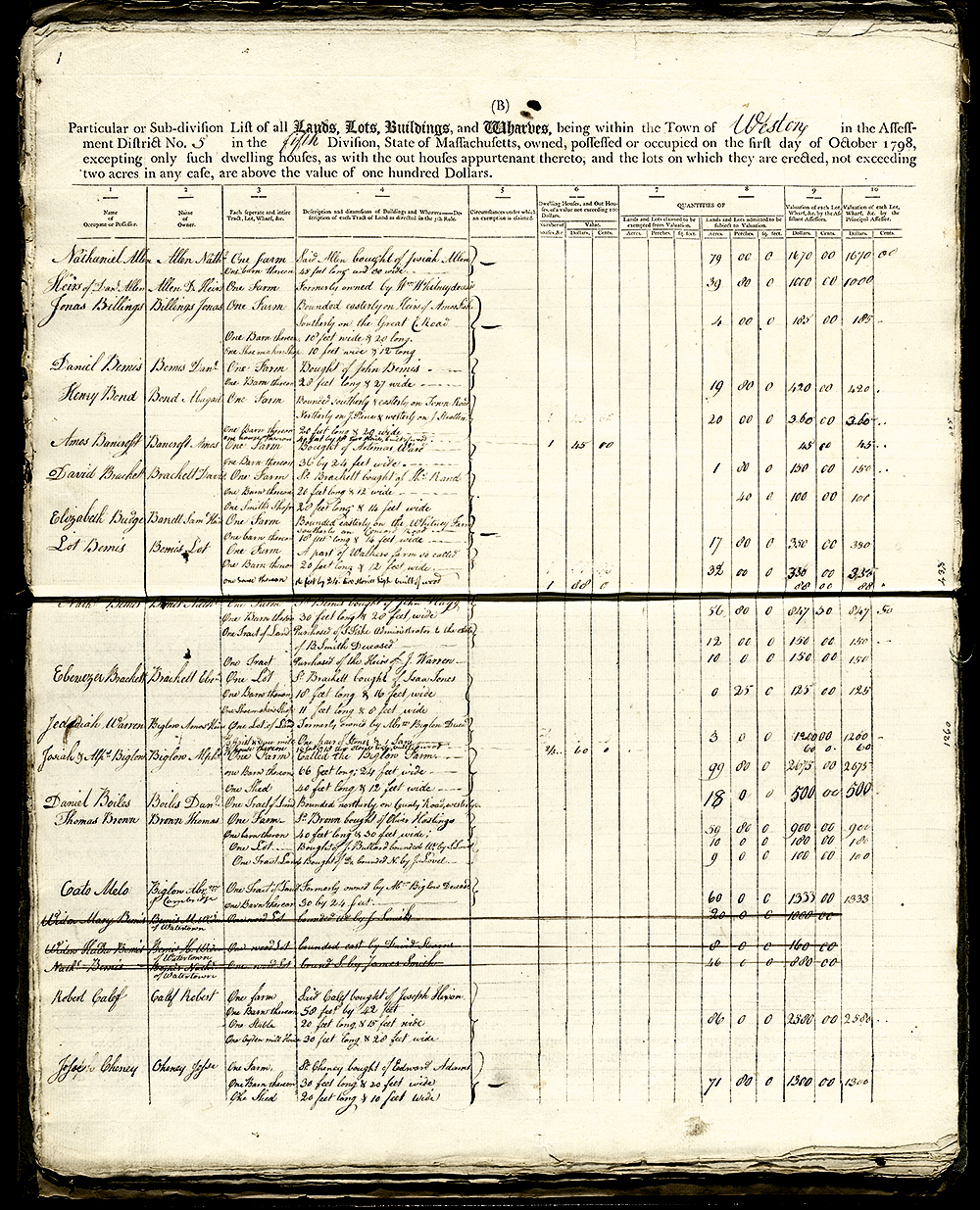

Barns and other important outbuildings were generally included in Schedule B, along with the value of the remaining land (not counting what was already listed in Schedule A). If the main house on the property was not worth at least 100 dollars, it was included in Schedule (B).

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Nathaniel Allen to Jesse Cheney

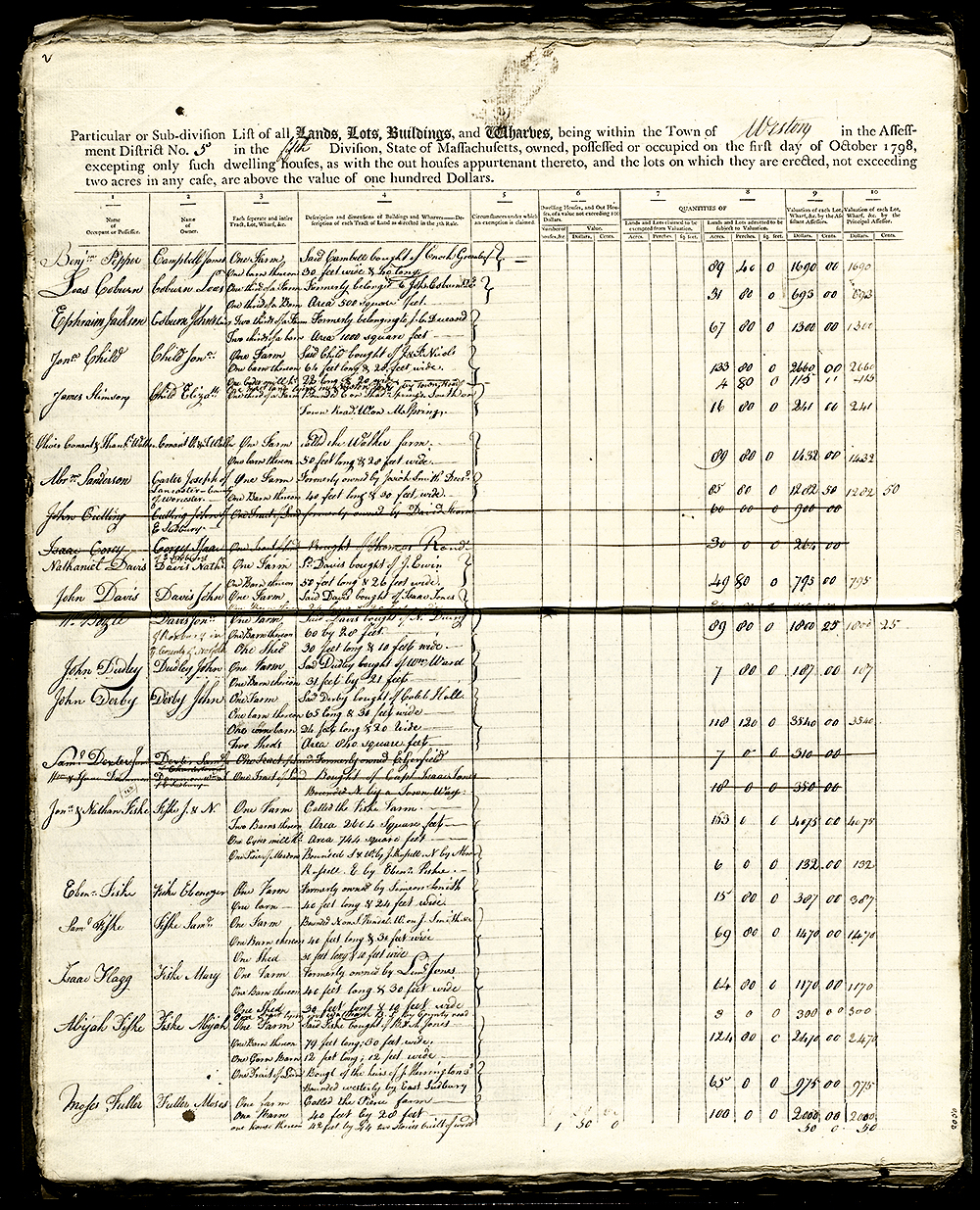

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: James Campbell to Moses Fuller

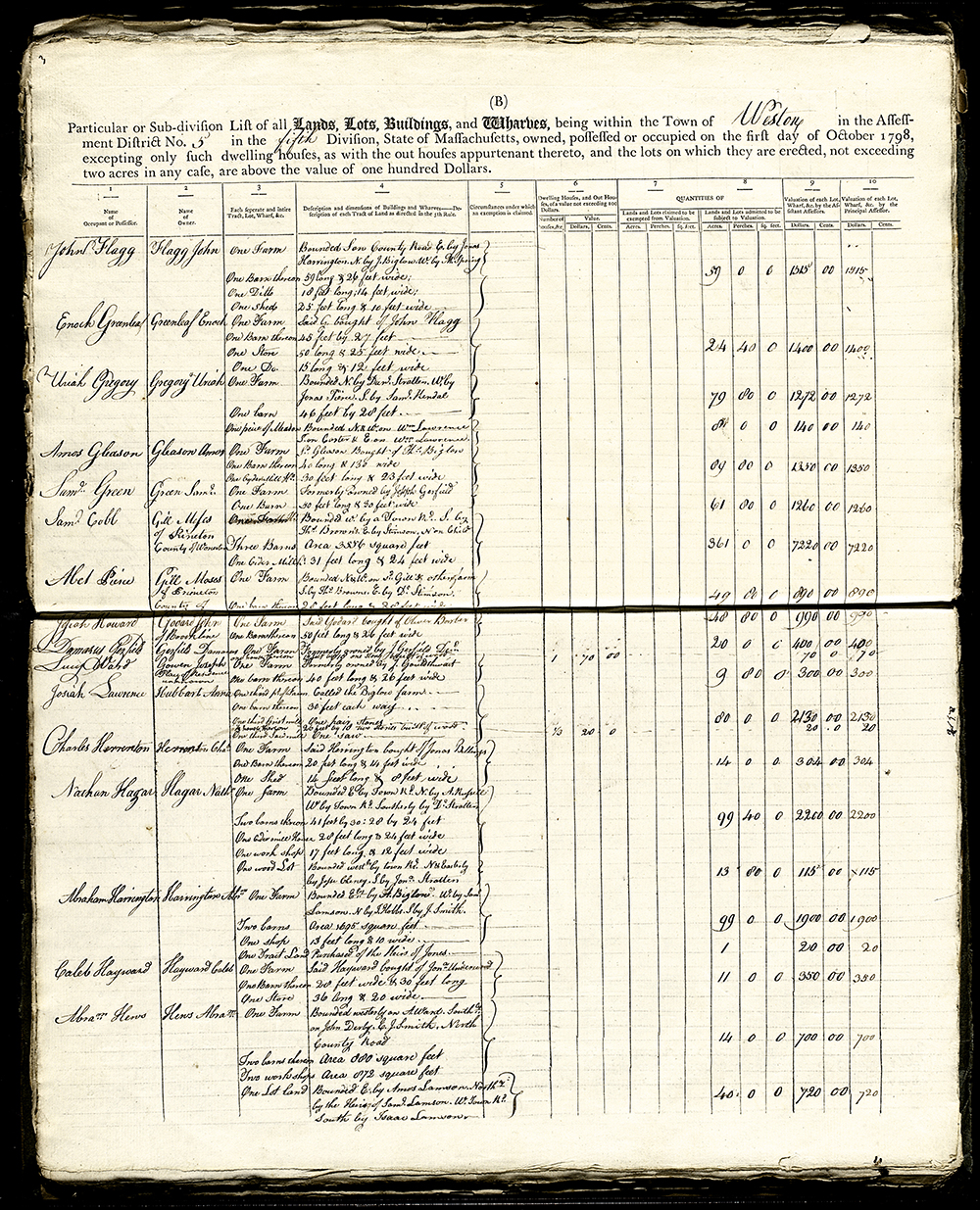

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: John Flagg to Abraham Hews

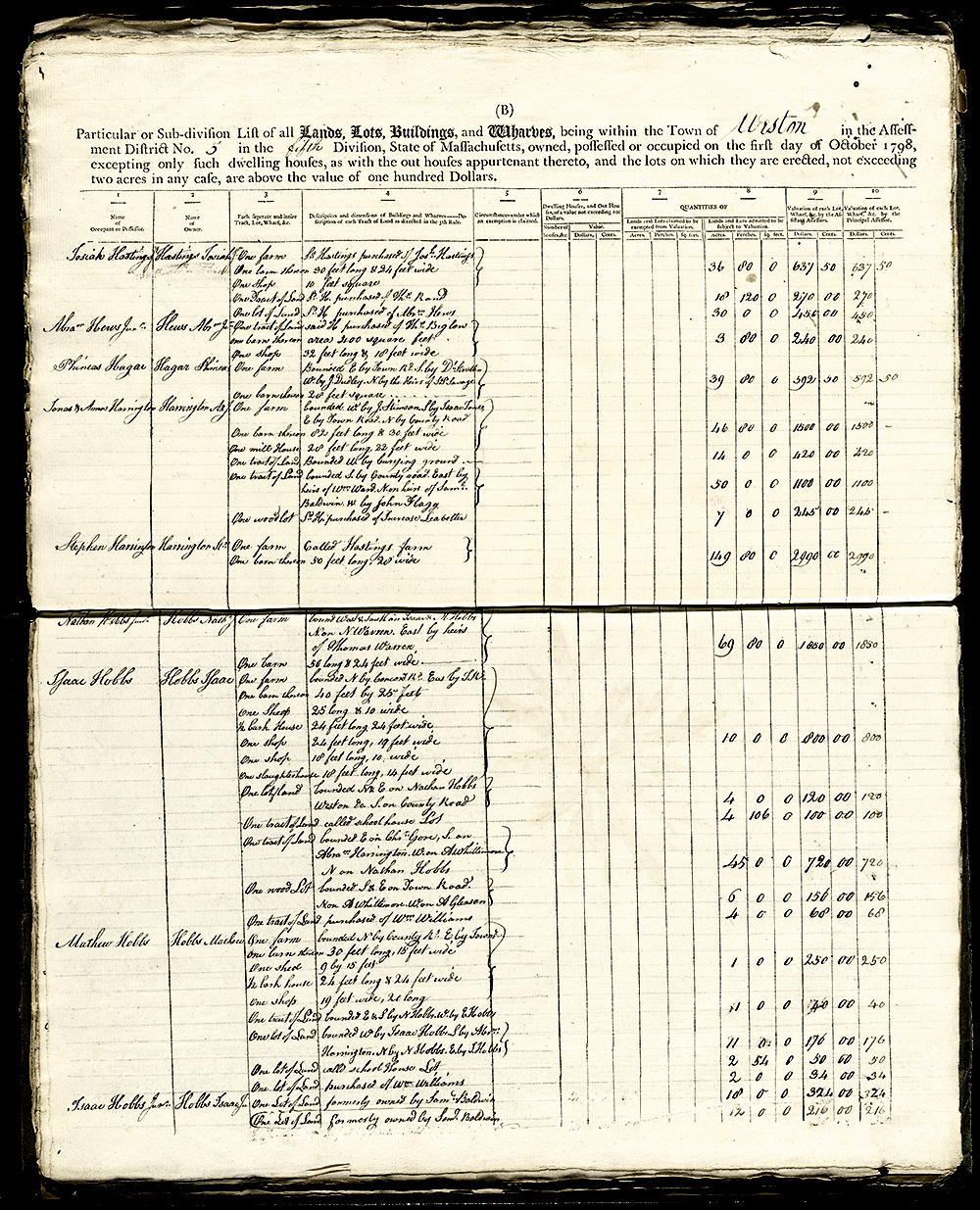

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Josiah Hastings to Isaac Hobbs Jr.

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Ebenezer Hobbs to Joel Leadbetter

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Joseph Leadbetter to Paul Pratt

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Jonas Pierce Jr. to Abigail Stimson

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Thaddeus Spring to David Stearns

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: Daniel Stratton to Joseph Severns

Schedule B: "Particular or Subdivision List of all Lands, Lots, Buildings, and Wharves." Column 2 is alphabetical by owner: H. Thomas Townsend to John Warren